On April 21, 2010, the Center welcomed Steven Maguire, PhD, a public finance specialist with the Congressional Research Service, who presented “Issues of Internet Taxation,” as part of the Center’s Tax Law Lunch & Learn Series. The John Marshall students and practitioners that attended Maguire’s presentation learned a great deal about the history of sales and use taxes, and current issues involving the taxation of Internet transactions.

“How many of you have purchased something over the Internet and not paid any sales tax?”

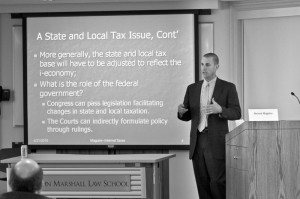

Steven Maguire, PhD, a public finance specialist with the Congressional Research Service, presents “Issues of Internet Taxation.”

Maguire started the presentation by asking the audience: “How many of you have purchased something over the Internet and not paid any sales tax? How many of you pay use tax on those purchases and file a use tax return?” According to Maguire, the biggest issue states are being faced with today is that of use tax collection. Many consumers are not aware that most states impose a use tax, which is a tax on the privilege of using tangible personal property within a state. Illinois residents who make purchases from out-of-state sellers (such as catalogue or Internet transactions) must file Form ST-44, the Illinois use tax return.

Maguire discussed three U.S. Supreme Court cases that lay the foundation for sales and use tax collection. In National Bellas Hess, Inc. v. Department of Revenue of Illinois, 386 U.S. 753 (1967), the Court held that requiring a vendor to collect use tax on out-of-state sales violated the due process clause, and created an unconstitutional burden on interstate commerce. A seller whose only connection with customers in the state is by common carrier lacks the requisite minimum contacts with the state.

The Court provided a four-part test for tax collection in Complete Auto Transit, Inc. v. Brady, 430 U.S. 274 (1977). A tax will not violate the commerce clause if the tax

- is applied to an activity with a substantial nexus with the taxing state;

- is fairly apportioned;

- does not discriminate against interstate commerce;

- is fairly related to the services provided by the state.

In Quill Corporation v. North Dakota, 504 U.S. 298 (1992), the Court analyzed the due process clause and commerce clauses separately. The Court held that the due process clause does not actually bar enforcement of a state’s use tax on an out-of-state vendor, but enforcement places an undue burden on interstate commerce.

The courts have indirectly formulated policy through their rulings, but it is ultimately Congress that has the authority to pass legislation to facilitate changes in state and local taxation. In Quill, the Court asked Congress to weigh in on the issue when they noted that “the underlying issue is not only one that Congress may be better qualified to resolve, but also one that Congress has the ultimate power to resolve.”

Congress has an opportunity to resolve the issue on sales and use tax collection if they pass legislation recognizing the Streamlined Sales and Use Tax Agreement (SSUTA). Membership to the SSUTA includes standardized definitions of products, simplified tax rates and administration, and standard rate-sourcing rules for cross-jurisdictional sales. Local governments, however, are not actively trying to pass the legislation, because they are unsure what they are going to get out of it. Until Congress passes legislation on the issue, states will continue to lose sales and use tax revenues to purchases made over the Internet.

By Angela McNeany LLM in Tax Law candidate

Maguire was a dynamic speaker, and had a way of connecting with attorneys and law students, and in return, taught us a bit on how to think like an economist. Dr. Maguire received his PhD in economics from the Andrew Young School of Policy Studies at Georgia State University.